Smart business financing options empower growth by pairing the right mix of capital with a clear strategy. Understanding business financing options for growth helps leaders align resources with ambitious milestones. Smart financing for growing businesses often blends debt, equity, grants, and alternative funding to balance speed with control. Access to loans and lines of credit for businesses remains a foundational tool for managing working capital and scale initiatives. By weighing grants and alternative funding for growth alongside venture capital and investors for business growth, you can tailor a plan that fits your stage and risk tolerance.

Beyond the headline term, growth capital options come in many forms, from debt facilities to equity partnerships. Viewed through an LSI lens, financing avenues for scaling a business include credit lines, venture funding, grants, and revenue-linked arrangements. Strategic funding sources such as partnerships, customer or supplier financing, and hybrid instruments can accelerate momentum without forcing a quick exit. Non-dilutive routes like grants and government programs offer value by preserving ownership while supporting specific initiatives. The key is to align the chosen path with milestones, cash flow realities, and governance needs, so expansion remains sustainable.

Smart business financing options: A guide to funding growth

Smart business financing options provide a framework for choosing the right mix of capital sources to accelerate growth. By aligning debt, equity, grants, and alternative funding with specific milestones—such as product launches, market expansion, or hiring ramps—you can reduce risk while preserving long-term value.

In practice, this approach means assessing your growth objectives and cash flow, then mapping each option to a measurable outcome. It mirrors the broader theme of business financing options for growth and smart financing for growing businesses, guiding decisions around loans and lines of credit for businesses, grants and alternative funding for growth, and the role of venture capital and investors for business growth.

Debt financing explained: loans and lines of credit for businesses

Debt financing is a cornerstone of Smart business financing options, offering predictable repayment and immediate liquidity without diluting ownership. It enables a fast response to growth needs, whether funding working capital, equipment, or capital projects tied to expansion.

When using loans and lines of credit for businesses, tailor terms to cash flow and growth tempo; use a line of credit for flexibility and term loans for planned investments. This approach helps preserve cash flow while supporting growth initiatives and aligns with overall business financing options for growth.

Grants and government programs: non-dilutive funding for growth

Grants and government programs provide non-dilutive funding that can accelerate R&D, create jobs, or support regional development. They offer a path to capital without equity dilution or debt burden, often triggering credibility with customers and partners.

To pursue them, identify aligned programs, craft concise proposals, and consider partnerships with research institutions. This aligns with grants and alternative funding for growth, and strategic collaborations can strengthen applications while expanding your funding toolkit.

Equity financing: venture capital and investors for business growth

Equity financing brings strategic capital and networks that can fuel rapid expansion, product scaling, or entry into new markets. It can unlock substantial resources when fast growth outpaces internal cash generation.

But it involves ownership dilution and governance trade-offs; ensure readiness with traction, a strong team, and defensible product-market fit. Consider whether you’re prepared for long-term partnerships and governance involvement typical of venture capital and investors for business growth.

Alternative funding methods: revenue-based financing, crowdfunding, and supplier funding

Alternative funding methods offer flexible repayment and access to broader investor or customer bases, complementing traditional debt and equity. Revenue-based financing, crowdfunding, and supplier or customer funding can smooth cycles and reduce upfront cash strain.

Use cases include revenue-based financing for variable cash flows, crowdfunding for market validation and community engagement, and supplier or customer funding to improve liquidity. These forms of alternative funding for growth require careful modeling and clear alignment with growth milestones.

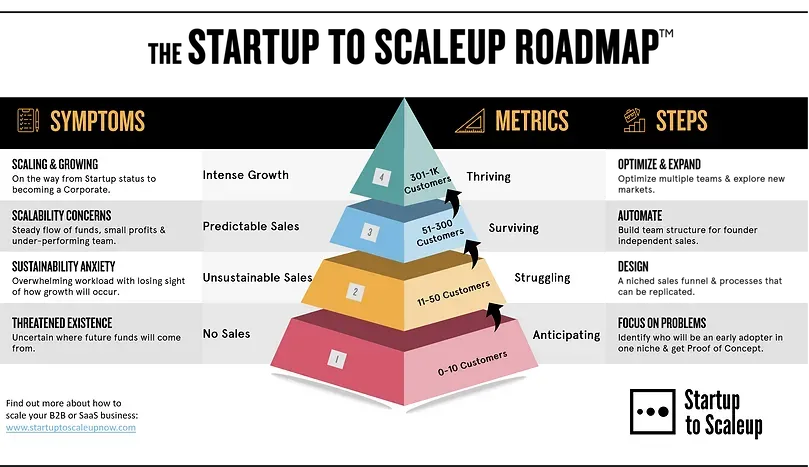

Building a financing plan that fits your growth trajectory

A structured financing plan ties capital to milestones, forecasts, and measurable outcomes. It helps ensure that the funding mix supports your growth trajectory without compromising financial resilience.

Steps include 12–24 month projections, milestone mapping, scenario planning, and a robust data room to speed diligence and improve odds of securing the right mix of financing options for growth. By tying funding to concrete objectives, you can optimize the balance between debt, equity, grants, and alternative funding to drive scalable results.

Frequently Asked Questions

Smart business financing options for growth: how do you choose between loans and lines of credit for businesses and venture capital for business growth?

Smart business financing options for growth often split into debt and equity. Debt, including loans and lines of credit for businesses, offers predictable costs and preserves ownership, while equity financing—venture capital and investors for business growth—can accelerate scale and bring strategic resources. The right mix depends on milestones, cash flow, and how much control you’re willing to share; many firms blend debt for runway with selective equity to fuel rapid expansion.

In Smart business financing options for growth, how can grants and alternative funding for growth complement traditional debt and equity?

Smart business financing options for growth emphasize non-dilutive capital like grants and alternative funding for growth to support specific initiatives while you layer in debt or equity for broader needs. Alternatives include revenue-based financing, crowdfunding, and supplier financing. Pros: non-dilution and flexible terms; Cons: program requirements and potentially higher costs if mismanaged. Identify suitable programs, tailor applications, and pair with debt/equity to cover broader growth goals.

What are the roles of venture capital and investors for business growth within Smart business financing options, and when is equity financing the right move?

Venture capital and investors for business growth can provide substantial capital, strategic guidance, and networks, a core component of Smart business financing options. Equity investment accelerates expansion but involves ownership dilution and governance commitments. Choose this route when you have scalable growth, clear traction, and an exit pathway, and you’re comfortable sharing decision rights with investors.

How should a company assess loans and lines of credit for businesses as part of Smart business financing options for growth?

Loans and lines of credit for businesses are a core part of Smart business financing options for growth. Evaluate the all-in cost, terms, covenants, repayment schedules, and fit with cash flow and milestones. Prepare robust financial projections, compare lenders, and decide between a line of credit for flexibility and a term loan for planned investments.

How do grants and alternative funding for growth fit into the Smart business financing options mix for growth?

Grants and alternative funding for growth fit into Smart business financing options as non-dilutive or flexible capital that supports specific initiatives without steering equity. Identify grants aligned with your industry and goals, and consider revenue-based financing or crowdfunding to complement debt or equity. Plan milestones, compliance, and reporting to ensure you can meet grant conditions while advancing growth.

What practical steps create a financing plan aligned with growth using Smart business financing options, including balance of debt, equity, and grants?

To implement Smart business financing options, build a financing plan around your growth trajectory. Create 12–24 month projections, map each funding option to milestones, and model multiple scenarios. Include a mix of debt (loans and lines of credit), selective equity (venture capital and investors for business growth), and grants/alternative funding as appropriate. Establish governance, diligence readiness, and a clear decision timetable to manage risk and maximize value.

| Topic | Key Points |

|---|---|

| Debt financing (loans and lines of credit) | Description: a common option with predictable repayment; quick access to capital; may support working capital, equipment, or growth initiatives. Pros: predictable cost; preserves ownership; fast funding with the right lender. Cons: requires creditworthiness and often collateral; cash flow impact; interest rate variability. How to use wisely: forecast cash flow, use lines of credit for flexibility and term loans for large investments, compare lenders for terms. |

| Grants and government programs: non-dilutive funding | Description: funding that does not require equity or debt; targeted for R&D, clean tech, job creation, or regional aims. Pros: non-dilutive; enhances credibility. Cons: highly competitive; lengthy processes; use-case and reporting requirements. How to pursue: identify aligned programs, prepare concise impact-focused applications, collaborate with research institutions to strengthen proposals. |

| Equity financing: venture capital and angel investors | Description: patient capital with strategic guidance; suitable for high-growth plans and speed. Pros: substantial capital; access to networks and credibility. Cons: ownership dilution; governance and exit expectations; ongoing reporting. When it fits: scalable models with clear growth and credible exit paths; traction and strong team; readiness for partnerships. |

| Alternative funding: revenue-based financing, crowdfunding, supplier/customer funding | Description: flexible options that complement traditional sources. Pros: revenue-linked repayments; broader investor/customer base; potentially less strict credit checks. Cons: higher per-dollar costs; crowdfunding requires marketing; supplier terms depend on relationships. Practical tips: use revenue-based financing with strong revenue visibility; craft compelling crowdfunding campaigns; negotiate favorable supplier terms. |

| Strategic financing: partnerships and hybrid structures | Description: vendor financing, channel partnerships, and milestone-based funding; hybrids like convertible notes or SAFEs. Pros: aligns capital with business development; can be less burdensome than traditional loans/equity. Cons: terms can be complex; valuation and governance considerations. How to structure: define milestones; include governance protections; ensure alignment with long-term strategy. |

| Building a financing plan | Requirements: 12–24 month projections; map funding to milestones; scenario planning (base, best, worst); quantify non-financial benefits; assess total cost of capital and time to close. |

| Criteria for choosing the financing mix | Factors: cost of capital; impact on control and governance; timing and speed; flexibility; strategic value beyond capital. |

| Practical pitfalls to avoid | Over-leveraging; misaligned terms; dilution without credible payoff; inadequate due diligence and financial modeling. |

| Real-world tips and a case example | Tips: start with a growth thesis; build a data room; consider staged funding. Case: Path C (revenue-based + modest equity) minimized dilution while preserving cash flow flexibility and unlocks later equity rounds. |

| Preparing to engage lenders/investors | Sharpen value proposition; gather projections and metrics; practice the pitch; define governance and capital allocation. |

Summary

Smart business financing options provide a structured approach to growth capital, combining debt, equity, grants, and alternative funding to align with a company’s objectives. This overview highlights how each option works, when to use it, and how to design a financing plan that balances speed, control, and cost. By mapping funding sources to milestones and considering strategic value beyond capital, businesses can accelerate growth while maintaining financial resilience.