Effective Business Budgeting is more than a spreadsheet exercise; it’s a disciplined approach that aligns every dollar with strategic growth and can guide budgeting strategies for small business toward sustainable competitive advantage. In today’s fast-changing markets, static annual budgets punish innovation; therefore, planning should blend foresight with adaptability, enabling teams to tighten discipline on costs while seizing new opportunities and reallocating resources rapidly. By weaving cost-saving budget tips into a broader framework, leaders can fund growth, such as new products, expanded sales channels, or improved customer success, without resorting to blunt cuts or arbitrary freezes. Core techniques like zero-based budgeting and rolling forecasts help keep the plan fresh, traceable, and aligned with measurable ROI rather than historical spend or inertia. This introductory guide outlines practical steps, real-world case examples, and a simple checklist to implement effective budgeting practices that deliver value, resilience, and scalable performance across departments and functions worldwide.

From a different perspective, the practice can be framed as strategic financial planning and expenditure management that guides resource allocation against defined goals. A spending plan that emphasizes ROI, KPI tracking, and scenario thinking helps teams respond to market shifts without starving growth. In organizational terms, this is a dynamic budgeting approach or forecast-driven cost control that blends foresight, discipline, and continuous learning. By focusing on value creation, prudent procurement, and automation, leaders can sustain agility while maintaining financial health.

Effective Business Budgeting: Aligning Dollars with Growth and Innovation

Effective Business Budgeting transcends spreadsheets; it’s a disciplined framework that links every dollar to strategic growth, ROI, and customer value. By weaving budgeting strategies for small business into daily decision-making, teams can prioritize investments that drive measurable outcomes while preserving cash flow for innovation. This approach helps finance and operating leaders collaborate around a common set of objectives, ensuring that resources are directed toward initiatives with the strongest strategic payoff.

Rather than treating budgets as static targets, this mindset embraces adaptability, prioritization, and continuous learning. The result is a dynamic foundation where cost controls and growth bets co-exist. Integrating zero-based budgeting, rolling forecasts, and value-based allocation makes the budget a living plan that reflects changing market signals and internal performance, all while maintaining fiscal discipline.

Rolling Forecasts: Keeping Budgets Flexible in a Fast-Changing Market

Rolling forecasts replace the old fixed-year plan with a continuous planning process that updates assumptions on a monthly or quarterly cadence. This method enables leaders to reallocate resources, adjust headcount, and recalibrate capex as new data arrives. It’s a practical form of operational efficiency budgeting that keeps the organization aligned with strategy without sacrificing agility.

By tying forecast updates to clearly defined KPIs such as CAC, LTV, gross margin, and payback period, teams gain a shared view of risk and opportunity. Rolling forecasts act as a fluid control mechanism, helping to avoid over-commitment in boom times and under-investment when conditions soften. In this way, budgeting becomes a proactive tool for sustaining growth under uncertainty.

Zero-Based Budgeting: Justifying Every Dollar to Eliminate Waste

Zero-based budgeting (ZBB) starts each period from a clean slate, requiring teams to justify every expense rather than merely adjusting the prior year. This rigorous approach exposes redundancies, underused services, and high-impact opportunities to reallocate funds toward growth initiatives. ZBB is a powerful instrument in cost-saving budget tips when applied selectively to non-core areas while preserving strategic investments.

In practice, ZBB supports value-based budgeting by forcing decisions on what truly creates value for customers and shareholders. When combined with activity-based budgeting and scenario planning, it helps organizations build lean cost structures that scale with demand, ensuring resources flow toward activities that deliver clear ROI.

Value-Based Allocation: Prioritizing High-Impact Initiatives for Growth

Value-based allocation centers budgeting decisions on the projects and departments that deliver the most strategic advantage. This approach aligns spend with expected ROI, profitability, and customer value, ensuring that every dollar contributes to growth. It also reinforces the use of budgeting strategies for small business teams to stay focused on high-impact activities rather than chasing low-return initiatives.

To sustain this discipline, organizations frequently employ scenario planning to prepare for multiple outcomes and continuously optimize the mix of investments. By regularly reviewing performance against KPIs and re-prioritizing resources, the business can accelerate growth while maintaining tight cost controls.

Cost-Saving Budget Tips: Practical Ways to Improve Margins Without Slowing Growth

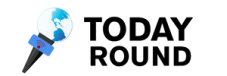

Cost-saving budget tips with real impact include renegotiating vendor contracts, consolidating suppliers, and cutting unnecessary subscriptions. Automation and process improvements reduce repetitive tasks, freeing up capital for revenue-driving initiatives. These steps exemplify how operational efficiency budgeting can deliver meaningful savings without harming customer value.

Beyond tactical cuts, fostering a culture of cost discipline across teams helps sustain savings over time. Linking expenditures to measurable KPIs and regular reviews ensures that savings translate into improved profitability and growth, rather than simply shrinking the budget. The goal is to preserve investment in core capabilities while eliminating non-essential spend.

Roadmap to Implementation: A Step-by-Step Plan for Sustainable Budgeting

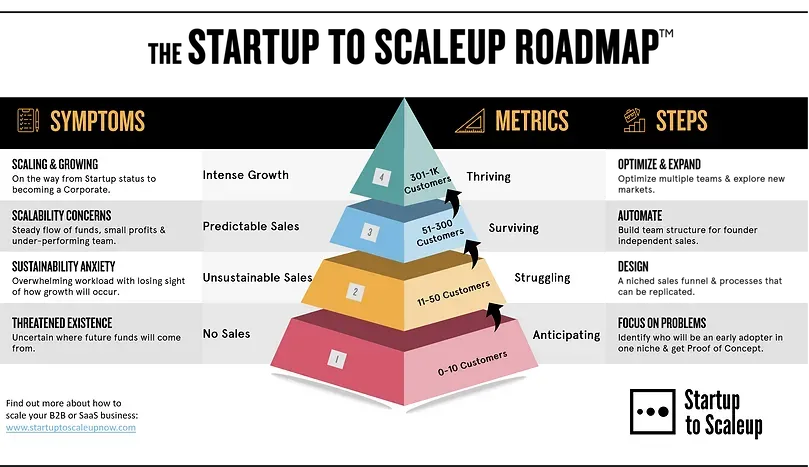

A practical implementation begins with defining growth priorities and guardrails for the next 12–18 months. Build a base budget using activity-based inputs, then apply zero-based budgeting where it adds value to discretionary spend. This phased approach helps institutions transition from a static mindset to a dynamic budgeting model.

Next, implement rolling forecasts and integrate scenario planning to prepare for varying conditions. Establish a cadence for performance reviews, foster accountability, and cultivate a learning culture where data-driven recommendations guide continuous improvements. This roadmap connects day-to-day decisions with long-term growth, supported by budgeting strategies for small business that deliver durable value.

Frequently Asked Questions

What is Effective Business Budgeting and how do rolling forecasts support it?

Effective Business Budgeting is a dynamic framework that aligns every dollar with strategic growth rather than a static annual plan. Rolling forecasts update assumptions monthly or quarterly, enabling faster reallocation of resources to high‑impact initiatives while keeping cost discipline. This pairing keeps budgeting aligned with strategy and market realities.

How can zero-based budgeting be integrated into Effective Business Budgeting?

Zero-based budgeting (ZBB) requires justifying every expense from scratch, helping uncover waste and reallocate funds to ROI‑driven activities. Within Effective Business Budgeting, ZBB supports value‑based budgeting and continuous optimization, especially for discretionary or non‑core costs.

What are essential budgeting strategies for small business under Effective Business Budgeting?

Key budgeting strategies for small business include ROI‑oriented spend, value‑based budgeting, rolling forecasts for agility, and activity‑based budgeting. Scenario planning and continuous optimization help keep the budget aligned with growth goals in a practical, scalable way.

How do cost-saving budget tips contribute to growth in Effective Business Budgeting?

Cost-saving budget tips identify inefficiencies, such as redundant subscriptions or procurement gaps, while preserving investment in growth drivers. They fit into ROI tracking, rolling forecasts, and value‑based allocation to maintain lean operations without sacrificing value.

What is operational efficiency budgeting and why is it important within Effective Business Budgeting?

Operational efficiency budgeting focuses on aligning costs with value creation, optimizing processes, and funding high‑impact activities. It improves margins and supports scalable growth, making it a core element of Effective Business Budgeting.

How should I implement rolling forecasts to improve budgeting accuracy in Effective Business Budgeting?

Start with monthly or quarterly forecast updates, tie assumptions to KPIs like CAC, LTV, and gross margin, and use scenario planning to prepare for best/base/worst cases. Rolling forecasts create agility and stronger alignment with strategy within Effective Business Budgeting.

| Key Concept | What It Means / Why It Matters | Examples / Techniques |

|---|---|---|

| Moving from Static Plans to Flexible Forecasts | Abandons a single annual plan in favor of rolling forecasts that are updated monthly or quarterly, enabling reallocation and keeping the budget aligned with strategy. It emphasizes staying responsive to data without overspending. | – Adopt rolling forecasts; update assumptions regularly; reallocate headcount or capex; tie updates to strategic KPIs. |

| Core Principles That Drive Sustainable Savings and Growth | Foundational ideas that guide spending toward growth and efficiency: ROI focus, value-based budgeting, zero-based budgeting, scenario planning, and continuous optimization. | – ROI-oriented spend; – Value-based budgeting; – Zero-based budgeting (ZBB); – Scenario planning; – Continuous optimization. |

| Practical Techniques for Cost Management Without Sacrificing Growth | Tactics to manage costs while enabling growth through disciplined evaluation of expenses and investments. | – Zero-based budgeting for non-core areas; – Rolling forecasts for agility; – Activity-based budgeting; – ROI/payback focus; – Vendor negotiation; – Automation and efficiency; – Cost-control culture. |

| A Step-by-Step Roadmap to Implement Effective Business Budgeting | A practical sequence of steps to build and maintain an effective budgeting process. | 1) Define growth priorities and guardrails. 2) Build a base budget with activity-based inputs. 3) Apply zero-based budgeting where it adds value. 4) Implement rolling forecasts. 5) Integrate scenario planning. 6) Establish a performance review cadence. 7) Foster a culture of accountability and learning. |

| A Practical Case: SMB Budget Reboot Without Hurting Growth | Illustrates how a real-world SMB improved efficiency and growth by applying rolling forecasts and ZBB to non-core spend while protecting renewal and growth initiatives. | The SMB case shows reallocating funds toward high-ROI channels and automating onboarding to reduce burn rate and improve gross margins within two quarters. |

| Common Pitfalls to Avoid | Common mistakes that undermine budgeting efforts and growth. | – Treat budgeting as only cost-cutting; – Ignore data quality; – Overcomplicate models; – Under-communicate plans; – Fail to connect budget to performance. |

| A Simple Checklist for Implementing Effective Business Budgeting | Actionable steps to implement the budgeting approach. | – Define 3-5 growth priorities with outcomes; – Establish rolling forecast cadence; – Apply ZBB to non-core costs; – Link expenditures to KPIs; – Schedule quarterly reviews; – Improve procurement and automation; – Foster a cost-disciplined, growth-friendly culture. |